You might be in a situation where you need funding to grow your dropshipping store faster.

Shopify Capital can be a good option, but you should understand all the details before taking out a loan.

In this article, we'll explain how Shopify Capital works for dropshipping stores, who is eligible, and what the fees are.

We'll also discuss its pros and cons so you can decide if it's the right solution for you!

Tip: Have you already created your Shopify account? If not, sign up by clicking this link here to get a free 3-day trial + 1 month for $1!

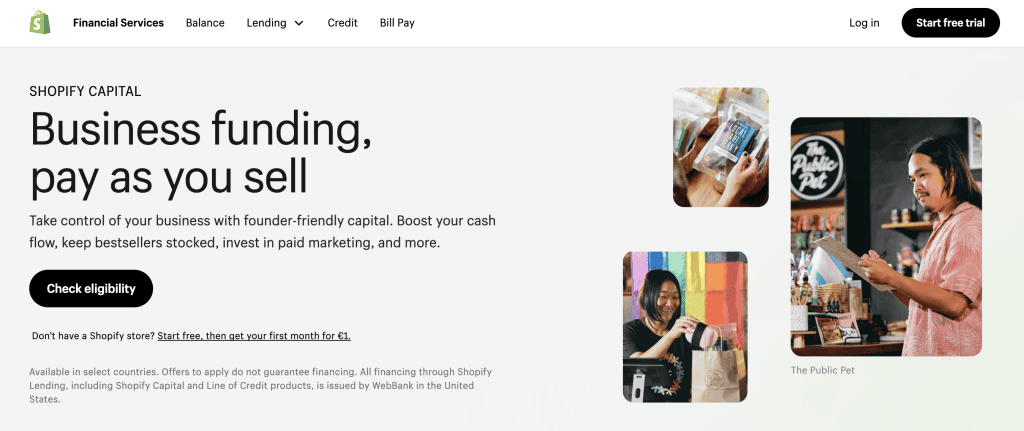

What is Shopify Capital?

Shopify Capital is a service offered by Shopify that provides funding for businesses that use Shopify as their ecommerce platform:

While Shopify Capital isn't exclusively for dropshippers, it is available to any Shopify user.

Unlike traditional loans, Shopify Capital takes into account a merchant's Shopify sales history and performance metrics.

This makes it more accessible to those who might not qualify for traditional funding options.

How does Shopify Capital work?

Shopify offers two types of capital: merchant cash advances and loans.

The main difference between these two options is how you repay the money.

Let's take a closer look at each.

1. Merchant cash advances

With a merchant cash advance, Shopify will give you a sum of money for a fixed fee. This loan is repaid with a percentage (remittance rate) of future daily sales.

For example, Shopify Capital might give you a $10,000 merchant cash advance with a fixed fee of $1,500, making the total repayment amount $11,500.

If the remittance rate is 10%, Shopify Capital will receive 10% of your store's gross daily sales until the full $11,500 is paid off.

Depending on your sales and remittance rate, repayment may take longer or shorter than 12 months.

Shopify mentions that there is no deadline for repaying the total cash advance to Shopify Capital.

As of 2024, merchant cash advances are available throughout the entire United States, as well as in parts of Canada, the United Kingdom, and Australia.

2. Merchant loans

With merchant loans, you receive a fixed sum of money in exchange for a fixed borrowing cost.

When you get accepted for the merchant loan, the loan will be deposited into your bank account, and you will repay it through a percentage of the sales you make on a daily basis.

When sales are low, you pay back less of the loan; when sales are high, you pay back more.

The main difference between merchant cash advances and merchant loans is that merchant loans must be repaid within a specific period. The repayment period used to be 12 months, but Shopify changed its policies in February 2024, which is now 18 months.

You must repay 30% of the loan amount during the first six months. By the end of the 12 months, 60% must be repaid, and by the 18th month, the entire loan amount must be repaid.

As of 2024, merchant loans are only available in a few states in the US.

How much money can you receive from Shopify Capital?

The amount of money you can receive from Shopify Capital depends on several factors, including your store's revenue, overall health, and your history with previous loans.

Based on these factors, Shopify Capital payouts can range from a few thousand to millions.

What are the requirements for Shopify Capital?

To get funding from Shopify Capital, you must meet specific requirements.

The minimum requirements for Shopify Capital are:

- You sell on Shopify. This is kind of obvious, but your store must be hosted on Shopify to be eligible for the funding program.

- Country you live in. Shopify Capital is currently only available in selected regions within the United States, Canada, the United Kingdom, and Australia.

- Minimum activity. Your store must have been operating on Shopify for at least 90 days.

- Shopify's policies. You must comply with Shopify's Acceptable Use Policy and Terms of Service.

- Shopify Payments. Your store must have Shopify Payments active to be accepted for Shopify Capital.

- Previous loans or advances. If you have previously taken out a loan from Shopify Capital, your repayment history and the status of your existing advances or loans will be considered when determining your eligibility.

The above points are must-haves if you wish to get funding. Additionally, Shopify considers the following:

- A machine learning algorithm. Shopify uses a machine learning algorithm to evaluate factors such as chargebacks, sales history, payment processing volume, and overall store performance.

- Business credit check. Shopify may perform a business credit check, especially if you apply for the loan rather than the merchant cash advance. A strong business credit history can increase your loan eligibility.

Shopify Capital doesn't conduct a personal credit check, which is standard with traditional loans.

5-Step walkthrough of using Shopify Capital for dropshipping

If you want to use Shopify Capital for your dropshipping store, this section is for you.

Here’s a five-step process to get you started.

1. Check if you're eligible for the loan

To check if you're eligible for Shopify Capital, first, login to your Shopify.

From the admin dashboard, head to 'Settings' and click 'Capital.'

If Shopify Capital isn't available in your region, you won't see the Capital settings option.

If you're eligible and live in the right region, you will see an invitation or a message indicating that you qualify for a loan or cash advance.

Shopify automatically determines eligibility based on factors like your store’s sales history, payment processing volume, and overall store performance.

2. Receive an offer from Shopify

If you're eligible for Shopify Capital, you can apply for funding from your Shopify admin dashboard's 'Capital' settings page.

Shopify will ask you to verify your identity and fill in your business details. If you don't use Shopify Payments as your payment provider, you also need to switch to it during the application process.

Once you've filled in the details, click 'Apply Now.'

After you apply, your request will be reviewed within one to three days. If accepted, you’ll receive your funds within two to five days.

3. Repayment to Shopify

Shopify Capital repayments are automatically calculated as a percentage of daily sales. This means a portion of your sales revenue will go towards repaying the loan every day.

After you receive your funding, the daily remittance begins within two days.

You can track your repayment progress through the Shopify Capital section in your admin panel. It will show the amount repaid and the remaining balance.

4. Allocate your funds

Next, plan how to use the funds to benefit your dropshipping store.

Shopify mentions that you can use the funds you receive for pretty much anything that helps to grow your business.

This could include tasks like:

- Purchasing inventory. For example, you might need to buy inventory if you want to expand your dropshipping business with a 3PL supplier. This may require investment in upfront costs.

- Advertising costs. Scaling fast can deplete your advertising budget, especially if payment processors like Stripe or PayPal hold your funds. In situations like this, investing your loan into advertising may make sense.

- Upgrade your website. If you think your website needs a revamp, you may want to hire someone to redesign your website.

- Expand product line. Testing new product lines can be costly, but if their potential is evident, investing loan money into them might be worthwhile.

No matter how you spend the money, keep detailed records so you can track the impact it has on your business.

5. Apply for a new loan

Once you have repaid 65% of your current loan, you become eligible for a new offer from Shopify Capital.

Obviously, not all dropshippers should take out a new loan, but if the first loan brought you good results, you might consider taking out another.

Similarly to the first loan, the funds are deposited to your account within two to five days if you get approved for the second loan. The repayment for the second loan starts only after you've paid off the first one.

The pros and cons of Shopify Capital

To help you decide whether Shopify Capital is the right option for you or not, let's look into its pros and cons.

The pros

Here are the pros of using Shopify Capital for dropshipping:

1. Quick application process

Checking if you are eligible for Shopify Capital is quick, and if you are, requesting the loan is also simple.

After you apply for a loan, Shopify promises to review your application within one to three days, which is also quick.

2. Fast access to funds

If you are accepted for funding from Shopify Capital, you will have access to the funds within two to five days.

This is relatively quick compared to alternatives, such as traditional bank loans.

3. Flexible repayment

Since repayments are tied to sales, there is no fixed term for repayment.

When you make fewer sales, you pay less, and when you make more sales, you pay more, making it easier to manage finances.

Shopify even mentions there is no deadline for remitting merchant cash advances to Shopify Capital.

4. No credit check

While Shopify Capital may require a business credit check, it does not require a personal credit check to take out a loan.

This makes it accessible to merchants who may have less-than-perfect credit scores.

The cons

Next, let's look into the cons.

1. Not available for non-Shopify users

Shopify Capital is only available for dropshippers who use Shopify.

For example, you can't use Shopify Capital if your store was created with BigCommerce, Woocommerce, or Wix.

2. Strict qualification

Not all merchants qualify for Shopify Capital.

For example, you must have used Shopify for 90 days, have a steady sales flow, and be in one of the countries where the funding is available.

This means that most dropshippers cannot take advantage of Shopify Capital.

3. Repayment structure

While the repayment structure is flexible, a portion of your sales will always go towards paying the Shopify Capital loan.

If you already have tight profit margins, it can seriously affect your bottom line.

FAQs about Shopify Capital

To help you understand Shopify Capital better, let's look into a couple of frequently asked questions about it.

How many times are you allowed to apply for Shopify Capital?

Shopify doesn't specify the number of times you can apply. However, Shopify community members mentioned applying successfully for it around eight times. So, if your sales are steady, Shopify will most likely give you funding multiple times.

How long does it take to get Shopify Capital funding?

Once you're approved, Shopify mentions that you can receive the money as quickly as in two days. However, most users report receiving the funds within two to five days.

Does Shopify Capital have an interest rate?

The merchant cash advance from Shopify Capital doesn't have an interest rate. Instead, Shopify uses a factor rate, which means you pay a fixed fee for the loan.

Conclusion

To summarize, Shopify Capital can be a great tool for accelerating your dropshipping business growth.

However, many dropshippers still can't use it simply because it's only available to a rather limited region, including parts of the United States, Canada, the United Kingdom, and Australia.

If you are located in an area where it is available and intend to use it, make sure you have a plan in place for repaying the loan. This will help you avoid a situation where you have a loan but no way to pay it back.

Want to learn more about dropshipping?

Ready to move your dropshipping store to the next level? Check out the articles below:

- Shopify Payments: The Definitive Guide (2024)

- The 7 Best Payment Gateways for Dropshipping Stores in 2024

- Dropshipping Payments: Everything You Need to Know in 2024

Plus, don't forget to check out our in-depth guide on how to start dropshipping here!